As we saw in our last blog post, even though digital transformations at financial services organizations are driven by the desire to satisfy customers and grow the business, whether or they happen or not depends on several factors. One of those is senior leadership’s appetite and attitude toward change.

When we conducted our 2023 Financial Services Executive Survey, we learned that the most important factor in determining an enterprise data and analytics leader’s maturity and receptiveness to digital transformation is the operating model of the company itself. Alignment between people, skills, and company culture is the most effective way to drive digital and organizational transformation for extraordinary results. However, the inner dynamics and tensions in this alignment, at every firm – big or small, retail bank or investment bank or insurer – was an eye-opener.

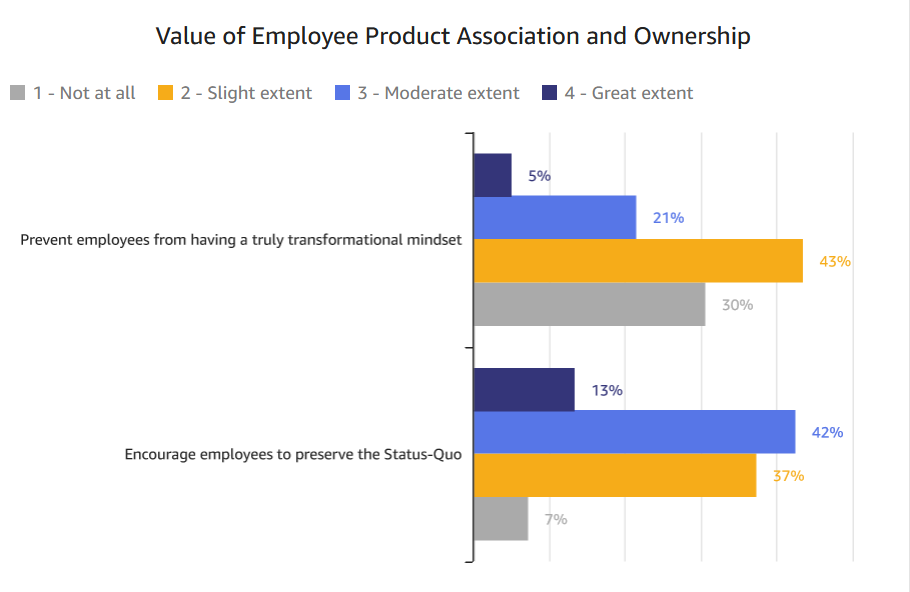

We asked participants how much company culture and attitude towards digital transformation are affected by employees feeling a sense of ownership of or association with the existing products, services, responsibilities/routines, organizational goals, financial results, and motivational systems. Surprisingly, we found that 55% of executives believe that ownership actually encourages the preservation of the status quo (thereby ignoring the pursuit of transformational change) and 26% believe that it prevents employees from having a truly transformational mindset.

Digital transformation helps organizations improve efficiency, maximize revenue, minimize costs, and even retain top talent. For financial services companies, digital transformations can also improve customer experience, which ultimately leads to more loyal customers. However, digital transformation, as the name implies, often requires organizations to make fundamental changes to their business practices and operating model to make it more agile, which can prove to be difficult.

An agile company is one that can quickly and successfully adapt business strategies and processes to respond to changing market conditions.

The Chief Data Officer at one Fortune 100 financial services firm compared the challenge of introducing an agile way of thinking to an entire organization, outside of the data services team, to changing the wheels on a train going 300 mph.

The question then becomes: how do you take an organization that is fine-tuned to perform efficiently month-to-month, quarter-to-quarter, and year-to-year, and put it on a transformational journey to becoming an agile company by asking employees to rethink the same processes that have kept it going in the past? How do you ask your teams that are already overwhelmed by running the business as usual to change and innovate by identifying new opportunities, inventing new business models, and designing novel business and technology architectures? For some, these could be seen as conflicting priorities that could lead to further tensions and inefficiencies.

Most companies have every intention of transforming themselves into agile organizations, but, as we saw in our research, when employees strongly identify with the existing products, services, responsibilities, routines, and organizational goals, it prevents them from embracing change. The “never fail” logic based on top-down risk avoidance, standardization, and stability employed by most of today’s incumbent, mature businesses is quite different from the mentality of a startup that is built on innovation, agility, risk-taking, and experimentation. Finally, performance goals and motivation systems in a mature, established business are typically focused on short-term (month, quarter, year) performance KPIs (e.g., earnings). However, an agile organization is focused on the long-term learnings in areas where little prior experience exists, such as improvement in customer engagement, lifetime value, or employee experience.

The disparity between employees’ identity, routine, and goals is real, and despite senior leadership’s desire for change, these sentiments cannot simply be ignored or expected to dissipate on their own. Most organizations are incapable of solving this challenge from the bottom up, so they require significant managerial intervention from the top down.

One of the most effective methods of intervention and ways to drive digital transformation is to create a structural separation by using experienced digital transformation consultants to help. External consultants are typically knowledgeable about the latest industry trends, have experience across a variety of companies, and have developed best practices and proven frameworks, so they are the best resources to advise companies on which changes to make and how to implement them.

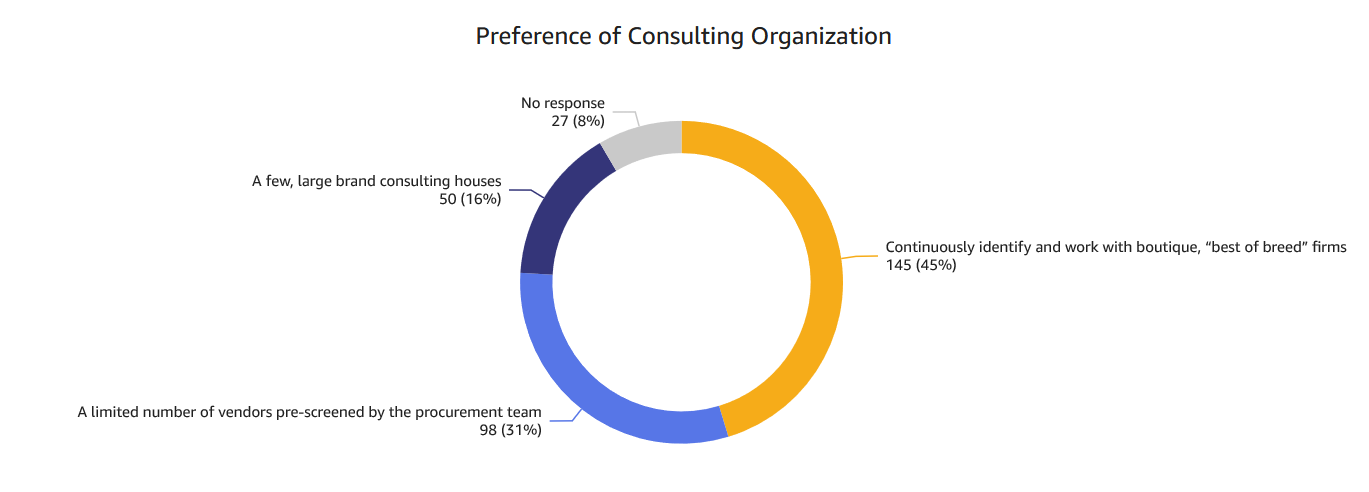

In fact, to ensure continuous innovation, 45% of participating executives said they opt to use boutique, “best of breed” consulting firms to advise on organizational changes and do not lock themselves into relationships with only a few pre-approved vendors. Instead, they regularly evaluate firms to find those who place the highest emphasis on industry-specific and functional domain data and analytics as key drivers of digital transformation.

Are you ready to begin your digital transformation and use your existing data to help your company become a more agile organization? Contact the consultants at Wavicle to learn more.