Digital transformations, defined as the use of technology to improve business operations and drive growth in new and existing markets, are key to an organization’s evolution and its ability to compete for customers’ attention and dollars. But what drives digital transformations at financial services firms?

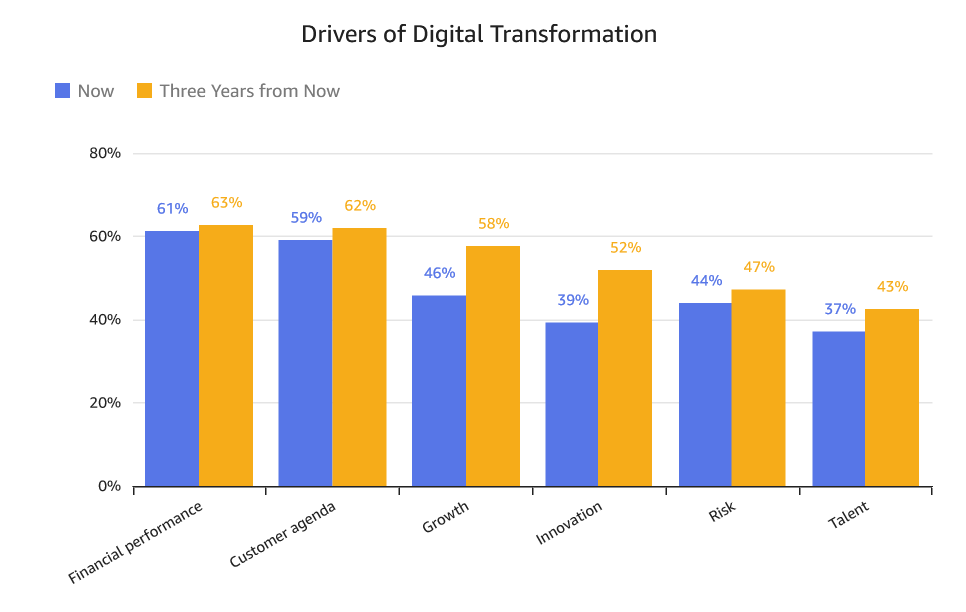

In our 2023 Financial Services Executive Survey, we asked C-suite executives what they thought the top drivers of digital transformation are today and what they foresee them being three years from now. The study confirms that the C-suite continues to bet on customers as a strategic driver of digital transformation. In fact, 62% of respondents cited customer agenda as a top driver today and predict it will continue to be three years from now. Growth in the market is right behind it today (46%), but they think it will play a much bigger role three years from now.

The top enablers of and roadblocks to digital transformations

Now that we know what’s driving the digital transformations at North American Financial Services firms of all sizes, let’s look at what actions C-suite executives are taking to enable their transformations and what’s holding them back. They:

- Are strategically investing in customer-centric capabilities with their digital transformations.

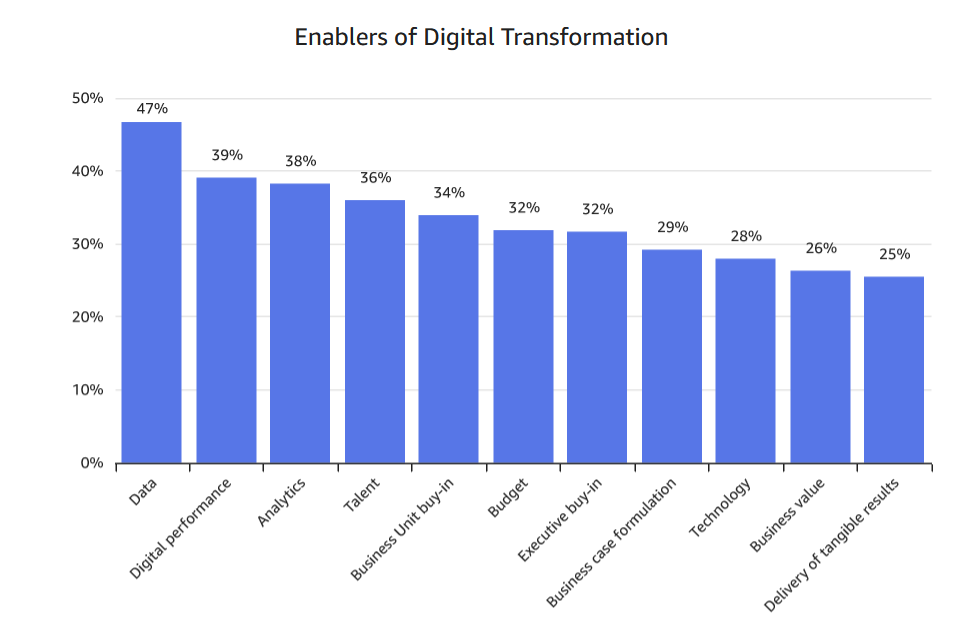

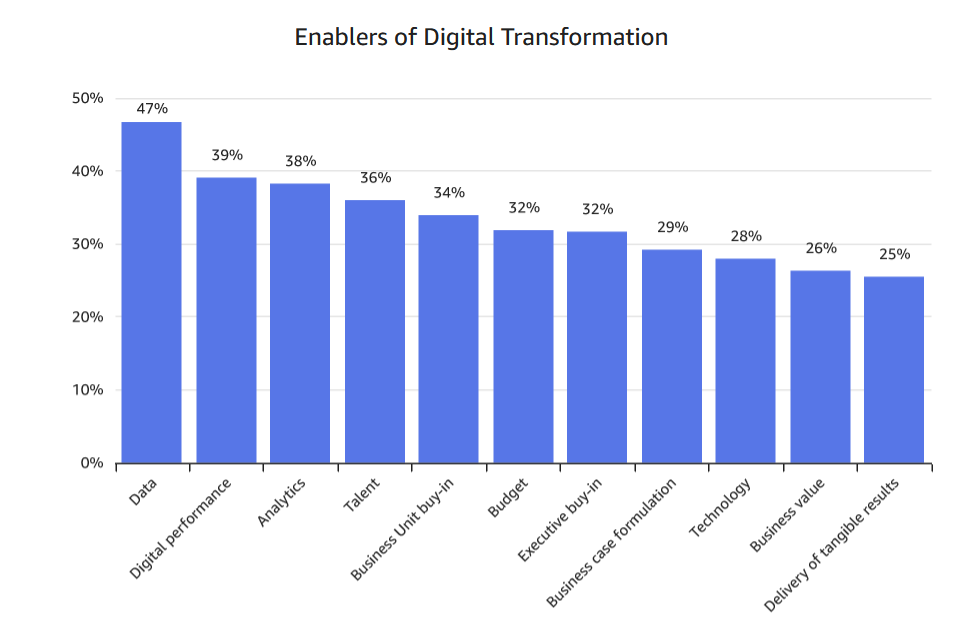

- Acknowledge that data, digital performance, and analytics/talent (tie) are the top enablers of digital transformation.

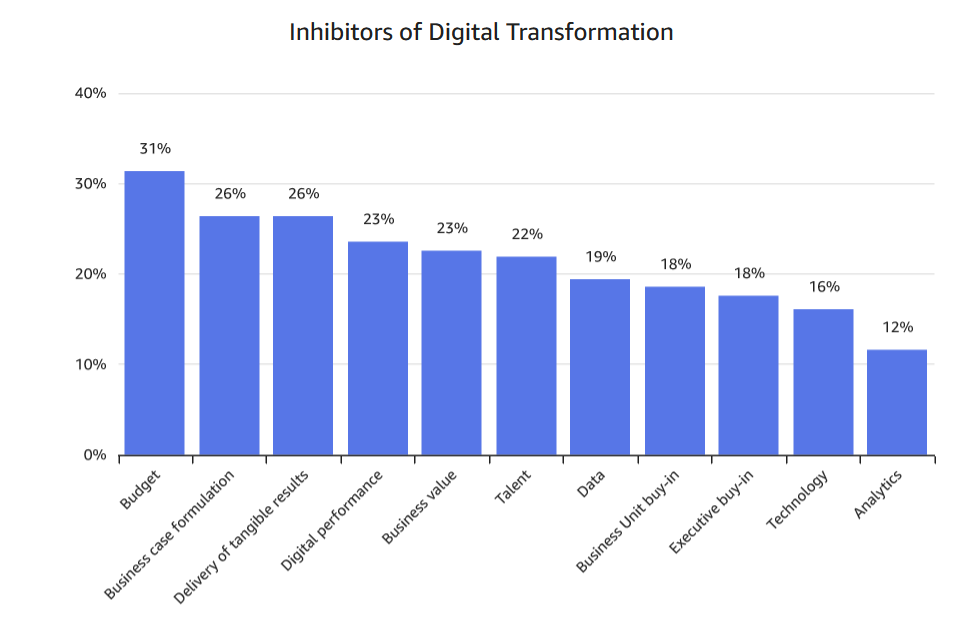

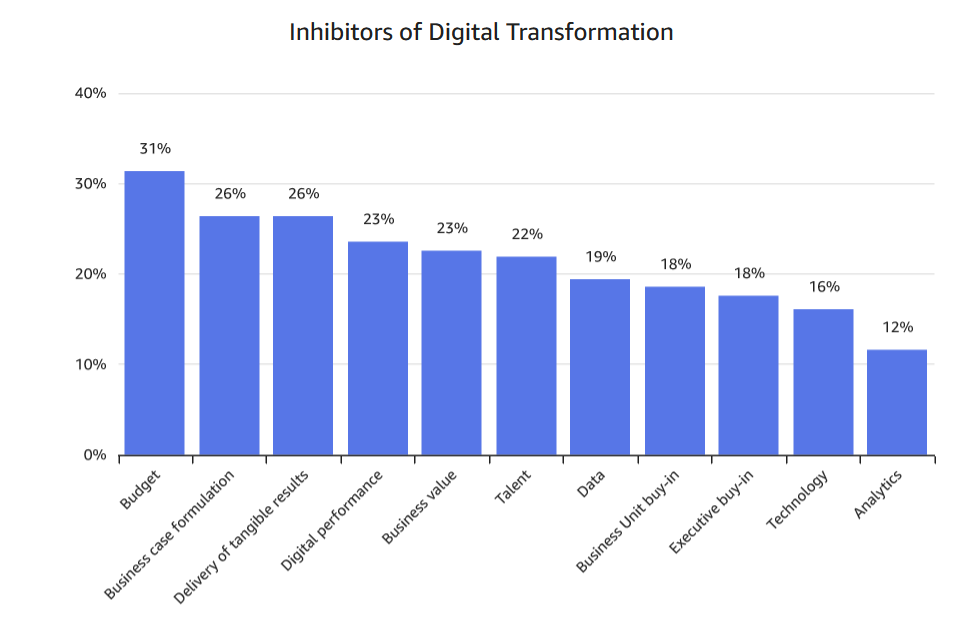

- Reveal that business case formulation and delivery of tangible value are top inhibitors closely behind budget.

This is significant because the number of digital transactions will only continue to increase with advances in technology, especially mobile, with upcoming 5G and beyond. The financial services sector has a big opportunity here to offer creative digital solutions beyond traditional products and services if they continue to enable and encourage their own digital transformations. In fact, this is how “digital native” fintech startups are disrupting the marketplace.

Leveraging the enablers and overcoming the roadblocks

The question is: how do financial services firms leverage the enablers and overcome the roadblocks to digital transformation? The answer lies in the enablers – analyze your customer data along with products, services, and related operational capabilities data from digital performance and talent to pre-assess the impact/value creation before embarking on a digital transformation effort. This will help:

- Formulate the business case – Focus on the impact/value across drivers – customers, operational abilities, and products/services – not the capabilities enabling the outcome.

- Define and closely align impact/value KPIs – not just financial metrics (ROI, CAC) but also non-financial metrics (NPS, CES) – to measure immediate impact and value creation over time. More importantly, shift focus from capability-focused ‘build progress’ KPIs to outcome-focused ‘impact/value’ KPIs.

- Allocate budget only for the minimum viable product (MVP) initially.

- Test and prove MVP outcome impact/value across customers, operations, and products/services.

- Scale MVP in alignment with outcome impact/value growth.

As an example, let’s take the challenge of customer retention. First, pre-assess the outcome impact/value of the digital transformation initiative across customers, products/services, and related operational abilities. Start small by analyzing customer data in a specific location (e.g., a city), along with a select few products (e.g., checking account, debit card), and operational abilities (e.g., marketing, digital servicing). This will help you identify and define outcomes, prioritizing high impact/value across customers, products/services, and operations to inform the creation of a strong business case for your MVP along with KPIs to capture impact/value. Then, once the MVP test proves its impact/value, you can scale it iteratively by allocating a budget to align with value growth and expand to other locations, customers, products/services, and operations.

From the solution delivery perspective, the time to market is significantly reduced with the right mix of talent, operational capabilities, cloud platforms, and data analytics capabilities, especially AI and machine learning. It is easier, faster, and cheaper than ever to not only build and operationalize a solution but also to auto-scale and auto-improve your capabilities in a dynamic, agile fashion to anticipate your customers’ needs and prescribe individualized product services.

Don’t let roadblocks delay your digital transformation efforts. Contact us today to learn how Wavicle’s proven high-business-value solutions, accelerators, and certified talent can help your company overcome these challenges.