Who can forget the “It’s Jake from State Farm” commercials? A woman hears her husband whispering on the phone in the middle night and grabs the phone from him only to discover it’s an insurance agent. While the appeal to get a quote or file a claim at any time – even late at night – may appeal to a large number of consumers, picking up the phone may not.

According to those surveyed for the Corinium Future of Insurance Report 2021, 55% of insurers believe that customers are now more likely to expect to ‘self-serve’ using digital. But, are you equipped to deliver that experience to them?

Accelerating digital transformation in the insurance industry

As you’d expect, property and casualty insurers are scrambling to accelerate their digital transformation, as are companies in most industries, following the events of the past year.

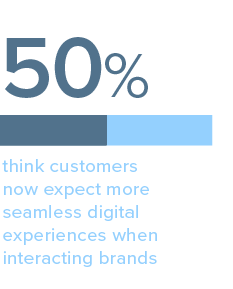

A big reason behind this push is the rapidly-evolving expectations of consumers. A 2020 Corinium Intelligence report found that 50% of CX professionals believe customers expect more seamless digital experiences when interacting with brands.

Those brands are not limited to Netflix and Amazon. Consumers want fast, convenient online interactions with all the companies they conduct business with, including their P&C insurers.

Robust data analytics strategies are the key to delivering the “Wow” experience that your customers expect.

1) Identify business needs and goals

Where do you start? The first step is to always identify your business goals, tie them to the KPIs you want to achieve, and determine how you can use data analytics to reach those objectives. Our insurance clients are primarily seeking to accomplish three key goals: streamline processes, meet regulatory demands, and improve the customer experience – all of which can positively impact consumers’ perception of the insurer.

While the insurance industry has typically been built on high-touch interactions, many insurers are finding they must adapt to win over today’s consumers. Advances in AI, like natural language processing (NLP), enable chatbots to quickly assist potential clients online. Machine learning (ML) can offer personalized digital experiences, such as providing instant premium quotes, based on customer data inputs and external data. Automation can also reduce the time needed to process and file claims, which can have a big impact on the bottom line. A McKinsey study reported that automation can cut the costs of a claims journey by as much as 30%. Of course, customers are thrilled to have their claims resolved quickly too. A win, win for both insurers and their customers.

2) Pair your goals with the right infrastructure needed to succeed

Most data analytics objectives and goals require a lot of data. If you’re using legacy systems, you will likely want to consider an upgrade to your data analytics technology stack; migrating to a cloud data platform. Why? Cloud data platforms are scalable, allowing you to store, process, and analyze large amounts of data cost-effectively and safely.

While security concerns were previously a barrier to public cloud adoption, the risks associated with public cloud platforms have declined markedly. According to Gartner, “Through 2020, public cloud Infrastructure as a Service (IaaS) workloads will suffer at least 60% fewer security incidents than those in traditional data centers.”

Security issues that do arise are more frequently due to implementation errors when establishing your cloud operation. Given insurers collect and use sensitive customer data, you need sound data governance and data management strategies to protect your clients’ information.

3) Enlist the right partner

Companies that attempt to utilize data analytics effectively often face a similar challenge – how best to build scalable solutions to allow greater access and flexibility of use. That struggle often comes from a lack of skilled resources, knowledge, or budget. In fact, 56% of companies surveyed by Gartner said that their staff’s skillset is the number one barrier to implementing AI.

Finding the right data analytics consultant can help. When searching, a consultant should understand the business problems you are trying to solve in order to propose a scalable, modern data architecture that will meet your needs now and in the future. A good consultant will also evaluate your current technology stack and recommend which tools and applications must be deployed to deliver optimal results while minimizing budgetary impacts.

Don’t fall behind

The reality is data analytics, automation, and AI are and will continue to reshape the way consumers interact with companies every day. And, while deploying new technologies may seem daunting, a great partner who understands your business objectives and possesses the technical skills to develop and deploy new solutions will certainly make it less so.

Download the Future of Insurance Data 2021 to learn more about the data analytics trends driving the insurance industry.