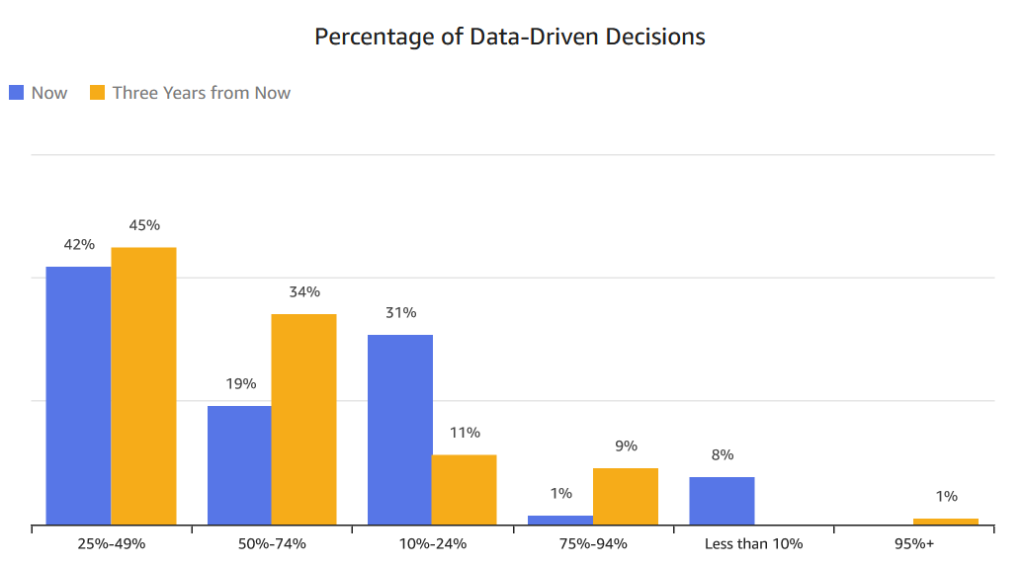

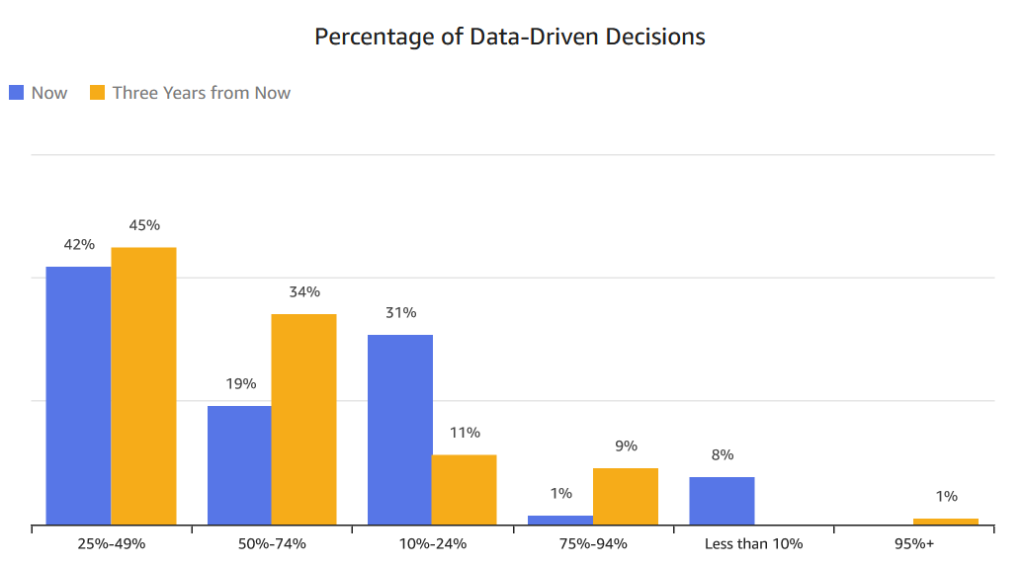

Companies that know the value of their data are better positioned to make informed and intelligent decisions that will ultimately benefit their organizations. However, our 2023 Financial Services Executive Survey revealed that a whopping 42% of financial services executives believe that only 25-49% of decisions at their companies are data-driven. Given the advances in data science capabilities, that number is shockingly low. Judging by these numbers, it’s clear that many financial services executives would benefit from increased awareness of standard tools that can improve decision intelligence.

Machine learning (ML), a component of artificial intelligence (AI), enables businesses to automate learning from data patterns to predict outcomes and prescribe actions, improving over time with minimal manual involvement. Effective decision intelligence is created using ML to automate and improve human decision-making, resulting in more informed and effective business decisions based on evidential data.

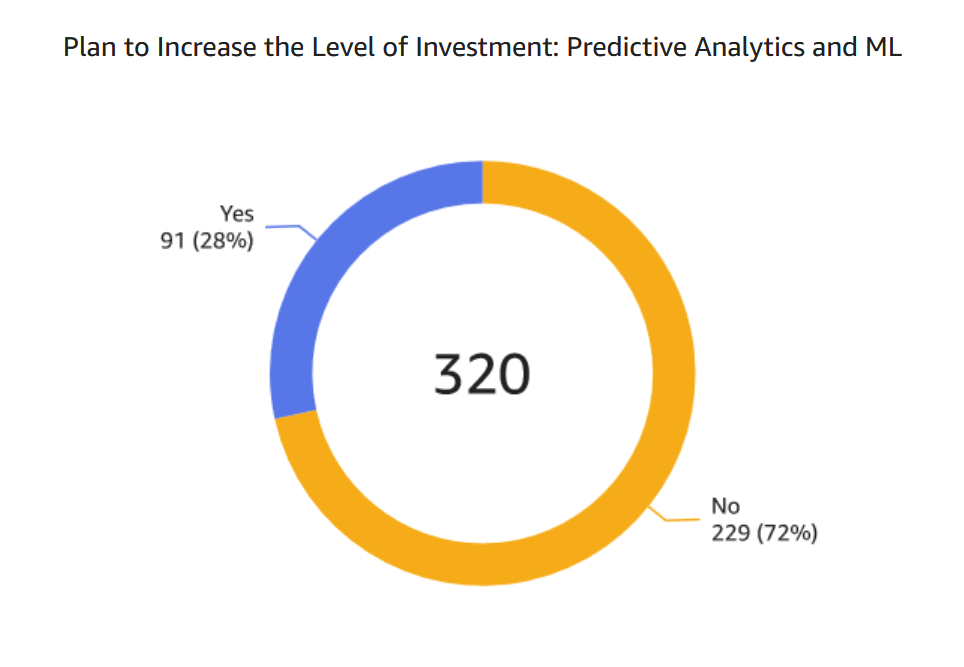

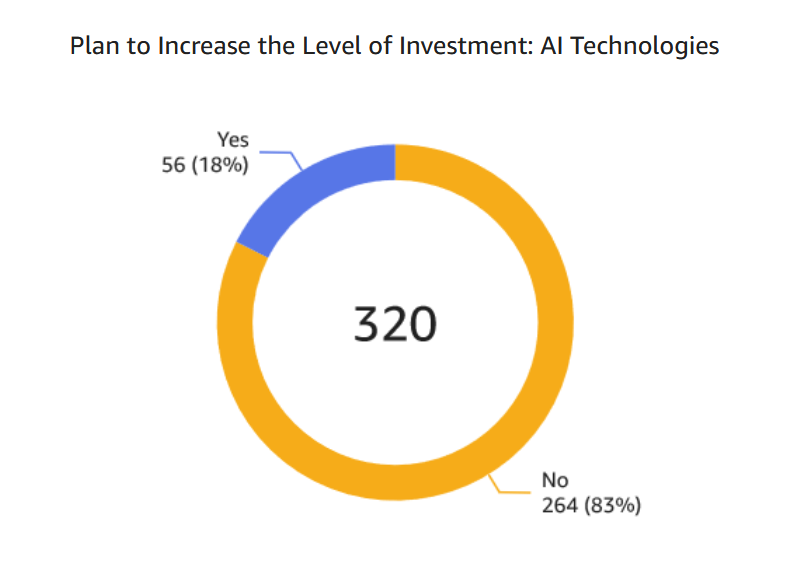

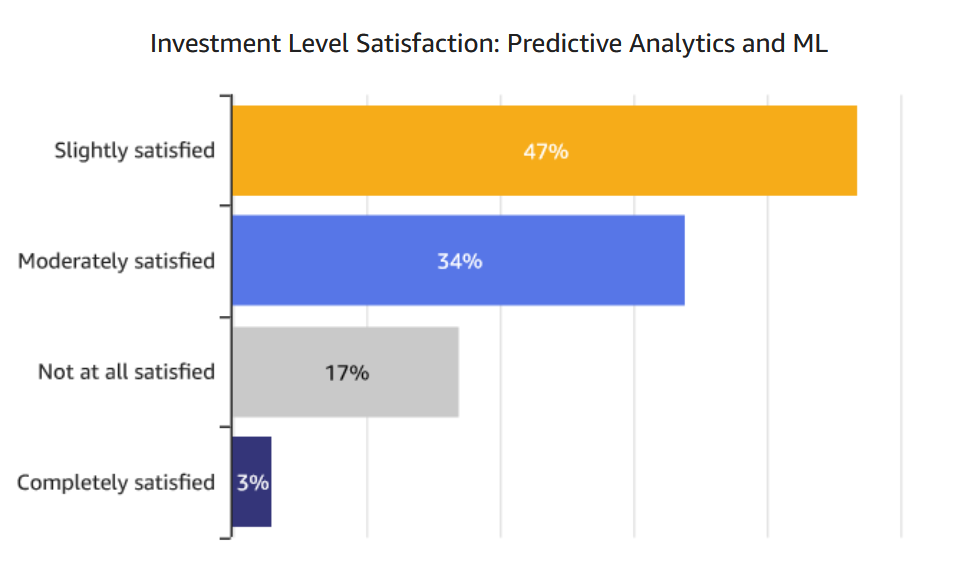

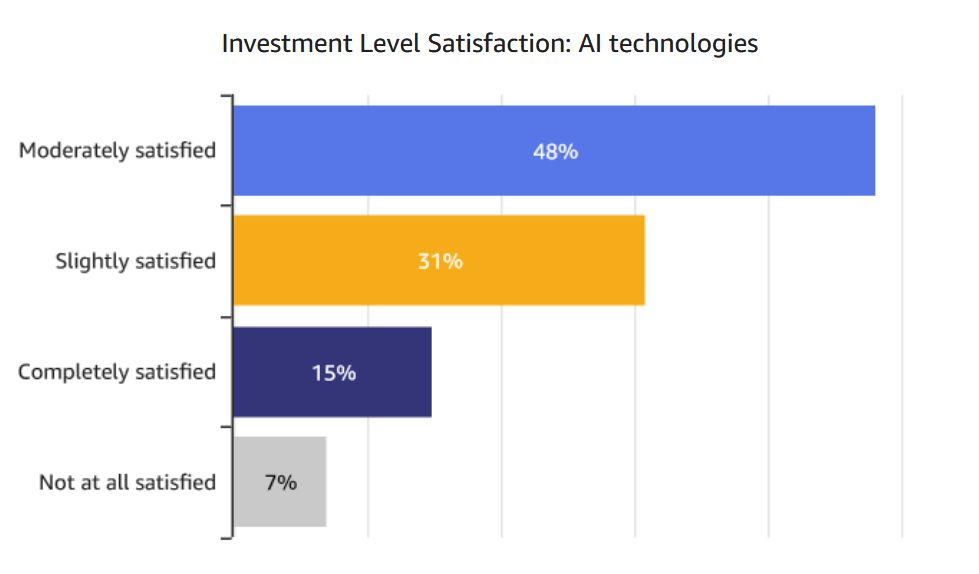

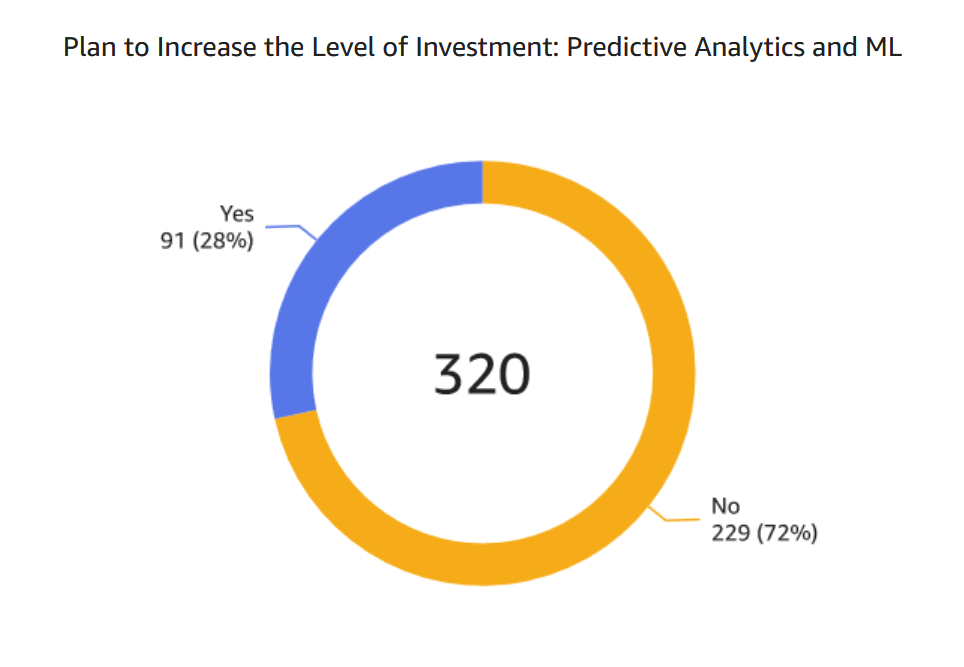

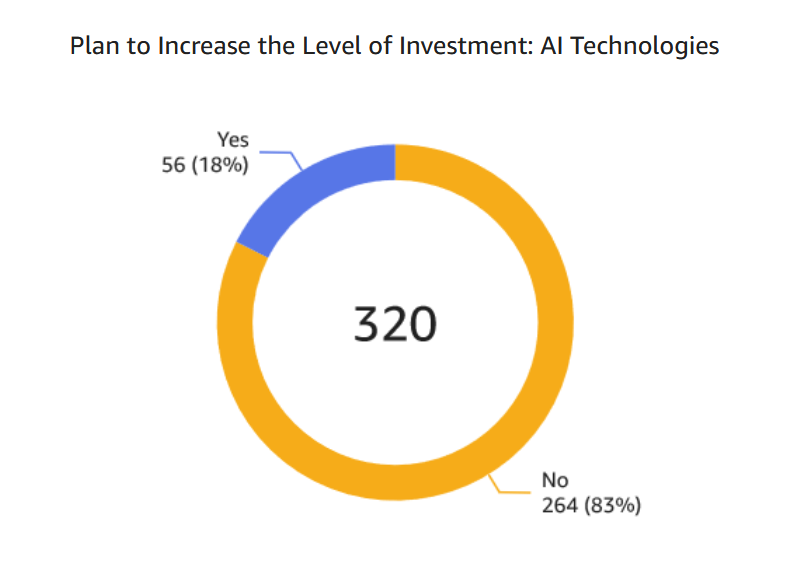

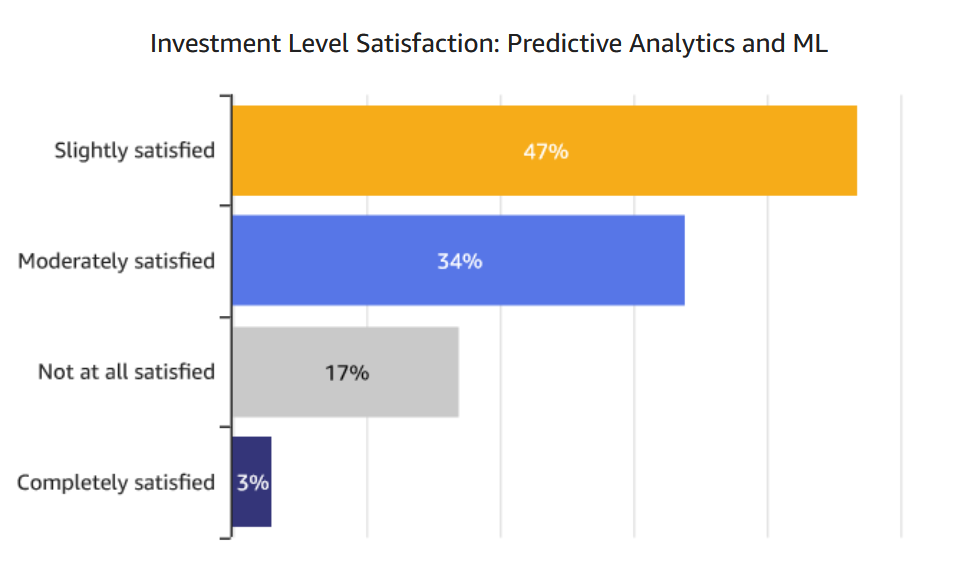

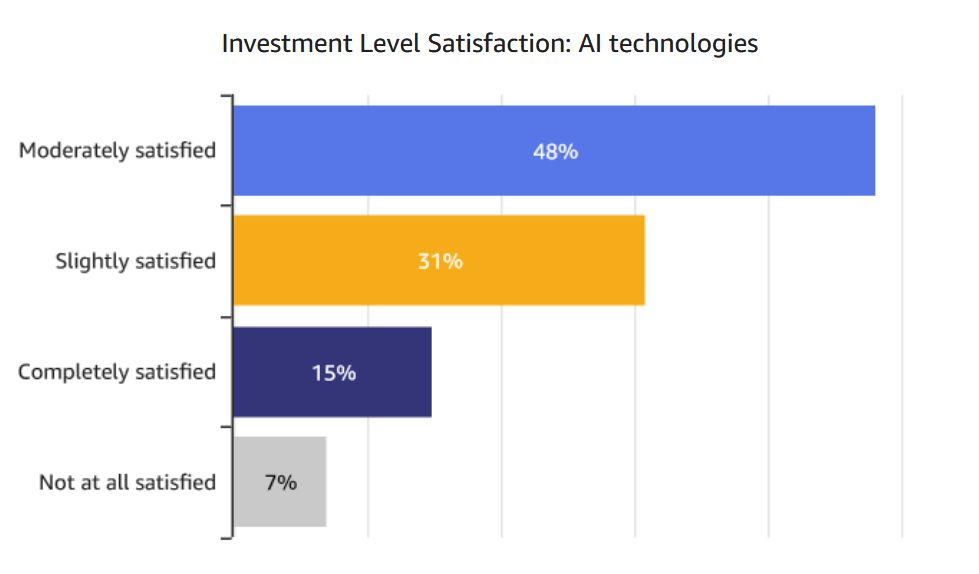

Our survey also shows that despite a lack of awareness and struggles to see the ROI from past investments in ML and AI, executives believe that data science and advanced analytics solutions like these technologies are the key to improving their organization’s ability to make data-driven decisions and the quality of their decision intelligence. In fact, many of them plan to increase their investment in these solutions.

One example of the benefits of machine learning is that by embedding ML algorithms into existing business operations, financial services companies can not only detect fraud schemes earlier, but they can also gain invaluable insights into their customers’ behavior. This will allow them to increase their understanding of their customers’ needs and improve customer processes, service levels, and customer satisfaction. In fact, this is how many of the big tech companies, like Amazon, Google, and Netflix, predict customers’ needs and prescribe products and services.

In banking, ML can also be the solution to better understanding large volumes of transactional data. Without ML, the data can be messy, ambiguous, and sometimes indecipherable, which keeps banks from gleaning valuable insights to improve their customer experience. With ML, not only is the data available much sooner, but it can also get more granular, so it can be used to understand a customer’s individual needs, thereby enabling banks to customize their services and align products with what customers really want.

Start to better understand your customers and improve data-driven decisions with advanced analytics solutions like ML and AI. Contact Wavicle to learn more about our customer value-focused solutions.