We are continuing to share insights from our 2023 Financial Services Executive Survey that was conducted with decision-makers from 320 North American financial services corporations. Today, we are taking a closer look at digital transformation through an organizational lens.

Surprising results

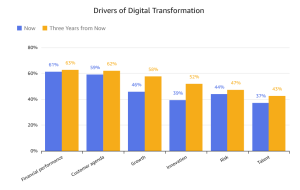

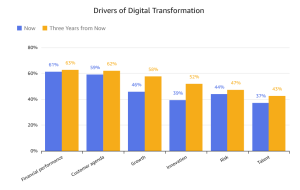

When asked to identify the top five drivers of their company’s transformation efforts, participants cited the following reasons:

- Innovation – 61%

- Risk and compliance – 59%

- Growth Agenda – 46%

- Talent – 44%

Even more interesting is that talent was also named the #4 enabler of organizational transformation after data, insights, and precision of analytics.

Even more interesting is that talent was also named the #4 enabler of organizational transformation after data, insights, and precision of analytics.

Executives in business, technology, and data and analytics functions unanimously agree that people, skills, and organization are the key components to building capabilities within their organizations. However, we were stunned to learn that in 53% of cases, talent acquisition is not aligned with the needs of the organization. For the same number of respondents, talent acquisition does not provide enough quality resources and talent development does not do a good job of keeping people onboard.

Bridging the talent gap with professional services

A consulting partner who specializes in financial services data and analytics can help bridge the talent and skill gap identified by business leaders as a major obstacle to successful digital transformation. With expertise in the areas of predictive modeling and machine learning, consultants offer businesses the opportunity to unlock valuable data and insights that were previously unavailable or underutilized. Insights like these can help drive competitive advantage. Additionally, these consultants can guide how to effectively manage the implementation of new technologies and systems to enable efficient processes and create more accurate results moving forward.

If the talent shortage or skills gap is standing in the way of your digital transformation, contact us to learn how our data, analytics, and AI consultants can help bridge the gap.

Even more interesting is that talent was also named the #4 enabler of organizational transformation after data, insights, and precision of analytics.

Even more interesting is that talent was also named the #4 enabler of organizational transformation after data, insights, and precision of analytics.