Over the last few months, Wavicle has conducted our 2023 Financial Services Executive Survey. The survey audience included C-level executives and senior decision-makers in the financial services sector (banking, insurance, and capital markets) in North America. We designed the survey to assess the maturity of their existing data and analytics functions that drive digital transformation and to measure the strength of alignment of their capabilities with value creation and realization.

We are excited to share our findings and strategic insights in a series of blog posts that empower you to drive digital transformation better, faster, and more impactfully than ever before.

Contrary to what is taught in business school about the importance of value generation and aligning technology innovations to value or to dozens of other metrics, many of our participants stated that realizing the value from their digital transformation efforts is not on C-level executives’ radar screen.

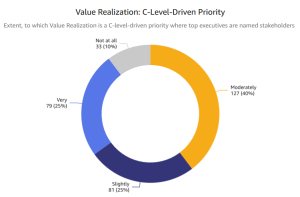

One of our surprising findings: Over one-third of respondents said that value realization was either not a C-level priority (10%) or it was only a slight priority (25%).

One of our surprising findings: Over one-third of respondents said that value realization was either not a C-level priority (10%) or it was only a slight priority (25%).

At “digital native” companies (e.g., insuretechs and fintechs), the C-suite focuses on value in 90% of the cases. How do companies like PayPal, Intuit, and Square create enormous value, and what can incumbent firms learn from them?

Digital natives know the power of leveraging data network effects to create “hockey stick” growth and encourage aggressive value realization. Tesla, for example, produces an enormous amount of data that, with the power of AI, makes other vehicles on the network more intelligent. More specifically, what separates those who can capture value from those who cannot is the ability to scale and maximize the learning effect of the network.

To do that requires organizations to build a robust digital platform capability, so innovations can quickly move from the “forever MVP” state to a production solution. Modernized data platforms and industrialized analytics environments are the principal components of a mature data and analytics capability.

While this insight is intuitive, it is also one of the key learnings in our survey: to capture value from their digital transformation efforts, companies need to articulate and quantify that value.

However, as our participants shared, defining and tracking value is an issue for many CFOs. Simply stated, executives have difficulty creating a quantitative or qualitative measure and tracking value creation/realization.

The winners in the digital transformation take it all. Others become obsolete. With clearly defined metrics for value realization and industrial-grade digital platforms that facilitate value creation and realization strategy, you can take your organization on an entirely new digital transformation journey.

To learn more about how Wavicle’s solutions for financial services companies can help you realize the value in your data, contact us to set up an initial call.